I was asked for an interview by WKOW while I was in Seattle for the CCIM Governance meetings. This is a perfect example of what seems like luck, but really, what it is years of preparation that comes together in that “lucky” moment. Since I was out-of-state, I suggested having a Zoom meeting. I know the power of visibility, and that people connect more when they both see and hear someone and can learn from them.

At first, we couldn’t connect on the Zoom link, the internet was too slow. The first inclination not wanting to lose the opportunity. It's easy for the mind to run rampant. I quickly redirected my thoughts to “What would it take to have clear internet connection?" Being on the 32nd floor of a large hotel tower, the timing was tight. The newscaster had an interview directly after me so we had to reschedule it to about 15-20 minutes later. In the interim, I got set up in the lobby, the Zoom link came through and we were golden! As in commercial real estate deals, there will always be surprises. It’s creating a winning solution.

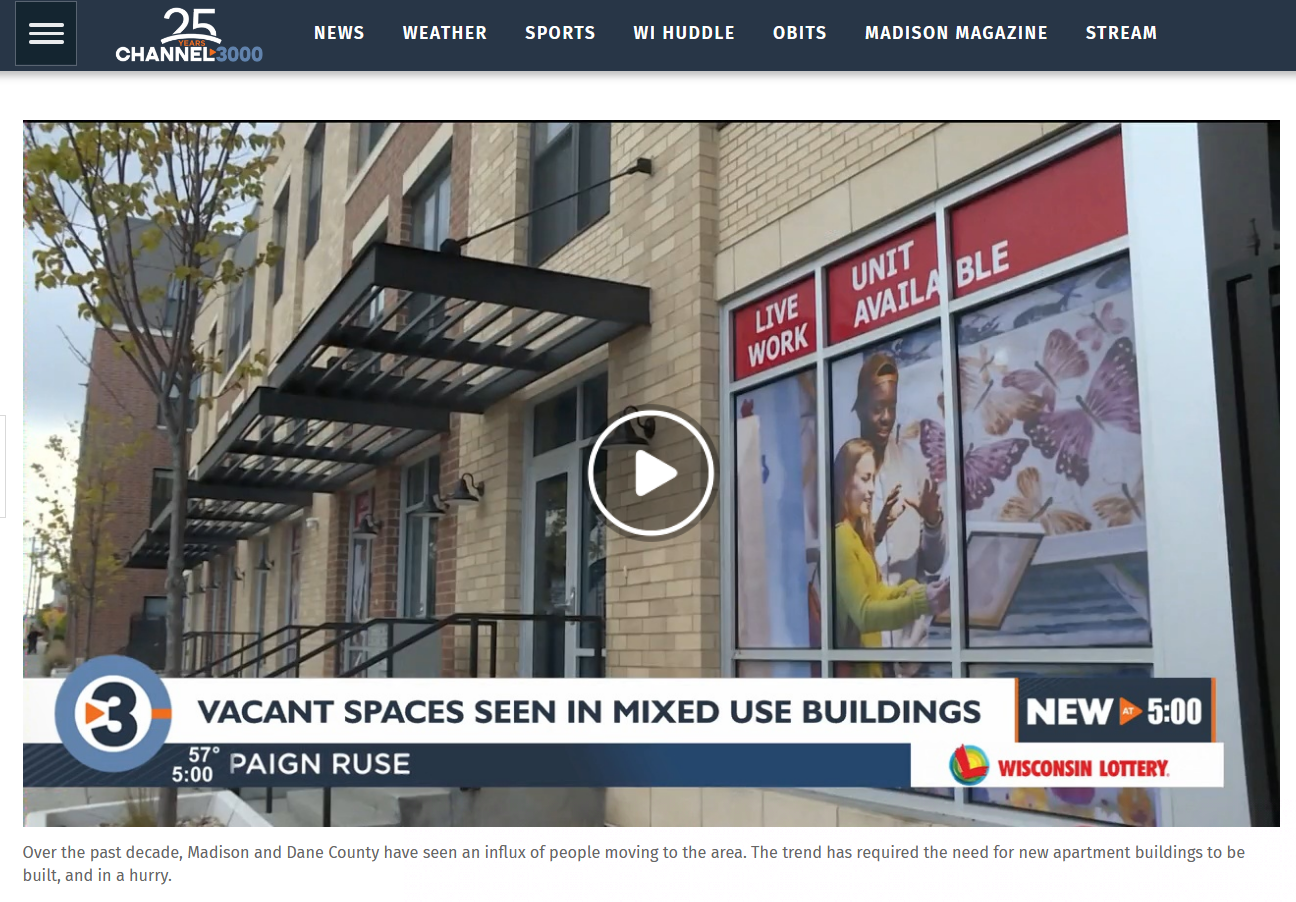

This blog consists of the insights behind the video interview which you may/not already seen via the evening news last week. The question was, with the new mixed-use developments throughout Madison, the suburbs, Dane County, why are they vacant? Is that due to our market only? Is it a nationwide thing? Do landlords actually want the space vacant? Are there tax write-offs, etc., etc.?

Let's review one at a time. Mixed use, which is commercial at grade, residential above, is really easy to lease out in certain areas and not in others. Areas where there's high pedestrian counts, significant vehicle traffic, and great parking ratios are very conducive for it. As you move to certain suburbs, like one that I leased several years ago, there wasn't even parking at the site. There was only street parking, which was really challenging from a brokerage leasing perspective because parking is a make or break decision for tenants. It was an area where there was some foot traffic, but it was by no means in the density of downtown Madison. It took years to get leased. I'm happy to say when the leases were executed, I negotiated the full asking price and a lower TI than we had anticipated. We really won across the board on that deal.

As you look to other suburbs, Verona, Fitchburg, parking ratios again come into play. And what will happen is when a property has been vacant for months or years, there's a natural assumption by people that something is wrong with the property or poor ownership/landlord, something along those lines, when really that's not always the case. Frequently, the price was inflated from the beginning or something shifted with parking. Maybe the TI (tenant improvement allowance) is small compared to what others in the market are offering. There are various factors at play.

In addition to parking, co-tenancy is a significant factor too. It depends on who is on either side of the vacant space or in line for it. Certain operators will only go where there's a significant national presence. Others, when they're local, maybe regional, are typically happy to go in there as long as it's a solid operator. It really depends on ownership's vision for the property, and it's up to the brokerage to bring in the aligned operators that have the financials, the business acumen, and the products or services that will line up and bring this as an amenity not only to the property but to the residents above and the community. This is where it's really an art on a grand scale.

As we shift into the vacancies, something people typically don't understand is that it's easier for a landlord to keep the vacant space than to just bring anyone in. There are two factors involved with that, one is liability. If someone doesn't operate correctly or if they're not paying rent as agreed upon in the lease, it's really challenging to remove a tenant. And then you have to go through small claims courts to which takes time, money and energy so it's a burden. At the end of this, sometimes they're not able to collect the money! Funds are not available. It's better to take the time upfront for due diligence, pulling the credit, pulling the financials, understanding their current operations, any other operations within Dane County, Wisconsin, nationwide, and go about it in an organized and repeatable process for all.

There are tax advantages in different ways for different opportunities. I always say, go to your CPA. Of course, if you have several properties in a portfolio, cost segregation is definitely the way to go. I highly recommend Yonah Weiss. I connected with him years ago on LinkedIn, and he really is the guru of cost segregation. If you're not familiar or you want to learn more, Google him, you'll find him on LinkedIn. Great great guy to follow.

Another thing to be cognizant of as well is that ever since COVID, it really removed the middle people. Prospects either have cash or significant funding and are ready to sign leases, buy properties, and invest or they don’t. When people are not in a financial position or even, I would say, the business mindset to begin something, they should continue their preparatory work. When people have several ideas but haven't clarified it into that “one” concept. They need to have their business plan and understand if they don't have the financing to talk with various lenders, see what's available for grants here in WI, Dane county and nationally. There’s no way to get around the due diligence process. It's not a sexy nor exciting for many people, and that's why they want to push it till the end. But it is actually one of the first things that you need to do as an operator because without a solid foundation, you're not going to be able to create the multiple stories that you desire to build on top of that foundation and increase your revenue in a repeatable and meaningful manner.

So those are a few tips. Some of this was highlighted in the interview, and of course, this is an additional backstory that was shared and a little something extra for you. Log for more musings of this manner each month in my future Blogs. If you have suggestions or topics you would like to learn about in commercial real estate, specifically retail, restaurants, and/or mixed-use, I would be happy to blog on these in future months.

As always, connect with me at

Heather@ABSTRACT-CRE.com or call

608-239-4781. Thanks!

CHANNEL3000 INTERVIEW

Longtime Madison area realtor Heather Ewing says another reason why small business owners are shying away from mixed-use buildings is due to the need for large upfront investments. She's the co-founder and CEO of Abstract Commercial Real Estate.

"So if you are a new operator, that's where having the existing build out is really helpful because otherwise they have to put in the electrical, the plumbing, HVAC are all of the different factors and it's very costly," Ewing said.

Empty mixed-use commercial space continues to plague Madison area | News | channel3000.com

Recent Posts